The Buzz on Pllc Vs Llc

Start Your LLC Now Back to Leading Comparing LLCs with Other Entity Types When forming an organisation, one of the most crucial steps is choosing business structure. There are numerous business entity options offered that each present different advantages and downsides. LLCs versus C Corps, S Corps, and DBAs Understand the essential benefits of LLCs, C Corporations, S Corporations and DBAs prior to deciding which entity type is ideal for you.

Furthermore, an LLC may offer a number of classes of subscription interest while an S corporation might only have one class of stock. Visit our short article on LLCs versus S corporations to discover other crucial differences. LLCs versus Collaborations and Sole Proprietorships Learn more about the benefits and drawbacks related to tax, property security and other essential requirements faced by LLC owners, sole owners and partners, whether basic or restricted partnerships in our article Sole Proprietorships, Collaborations and LLCs are Typically Utilized Entities.

There are numerous business entity alternatives offered that each present various benefits and drawbacks. Select your state to view detailed details: Start Your LLC Now Back to Leading LLC Resource Center See our list of LLC short articles, covering topics from formation state to tax implications. Selecting a state in which to form your organisation is a substantial choice.

There are significant distinctions in the method LLC s and Corporations are charged state costs, run under state law and taxed by federal and state federal governments. These aspects need to be thought about when choosing the organizational form for your organisation. If you think you can take advantage of the combined features of using an LLC to own and operate your small company and after that having it be taxed like an S corporation, evaluate the election of S Corp tax status for your LLC.

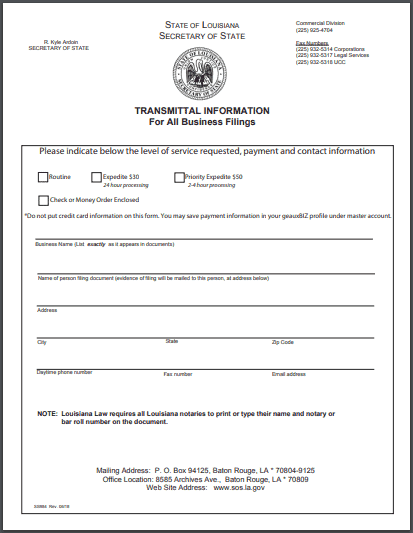

Thinking about moving your business to another state Find out about the key considerations and actions included. Get assistance on which files you require to maintain and which can be discarded in order to keep your LLC in compliance. Start Your LLC Now Back to Top LLC Frequently Asked Questions What LLC Kinds are needed to begin a limited liability company Articles of Company, often also called a Certificate of Organization, must be prepared and filed with the state.

An Unbiased View of Forming An Llc In California

If your LLC is formed through Biz Filings, all you need to do is total our simple LLC kinds and we will do the rest. We will prepare and file your Articles of Company and LLC forms and pay the preliminary filing charges in review your place. Who can form an LLCTypically, there are no residency or legal limitations as to who can start an LLC.

For more details regarding the requirements of each state, see the LLC Formation Requirements page of our state guides. Do I need a lawyer to form an LLC No, you can prepare and submit the Articles of Organization among the most important LLC forms needed yourself. Make certain you understand the requirements of your desired state of incorporation.

If you are uncertain of what service type is best for you, evaluate our Kinds of Company Comparison Table and/or try our Incorporation Wizard. If you still have concerns, seek advice from a lawyer or accounting professional. What must I name my LLC Selecting the name of a new company is an important choice.

Choosing a name that is easy for customers to keep in mind and spell also has benefits. Lawfully, the name you choose for your LLC needs to not be "deceptively similar" to any existing business in that state or should be "distinguishable on the record" of your state. Check your company name using our business name schedule checker.

Additionally, many states need that the name you select programs your company is an LLC by including the words "Minimal Liability Business" or the abbreviation of "LLC." The number of people are required to form an LLC There is no requirement defining the optimum number of members (owners) an LLC can have.

The Best Strategy To Use For Pllc Vs Llc

Tax of the one-member LLCs at the state level may be different. How is a restricted liability business (LLC) taxed Generally LLCs are taxed like collaborations, with pass-through taxation. While multi-member LLCs should submit an informational income tax return, single member LLCs do not. In both cases, the profits or losses are "passed-through" the organisation and reported on the owners' income tax return.

LLCs can also choose to be taxed like corporations, where the revenues of the LLC are taxed at business level. The state earnings tax treatment of LLC profits and losses may or may not mirror the IRS tax treatment depending on the state. LLCs are also based on any franchise taxes imposed by the state of incorporation.

Franchise taxes are generally due annually, and the amounts vary by state. Note: California LLCs are subject to a yearly minimum franchise tax of $800 annually. The first payment should be made within 3 months of forming your LLC. The state will send an expense to advise you to make this payment.